Blog

-

Posted: April 16, 2024Categories: BlogsRead More

At GPH, we stock a wide variety of decorative aggregates, also known as decorative stones, to suit any garden project. From classic gravel to colourful chippings and unique chuckies, you're sure to find the perfect option to add style and functionality to your outdoor space.

-

Posted: March 13, 2024Categories: BlogsRead More

Making the most of your outdoor space is important this time of year, with summer just around the corner. If you’re looking to install some fresh new decking or bring some life back to your pre-existing setup, we’ve got the knowledge you need on how to do so.

-

Posted: February 15, 2024Categories: BlogsRead More

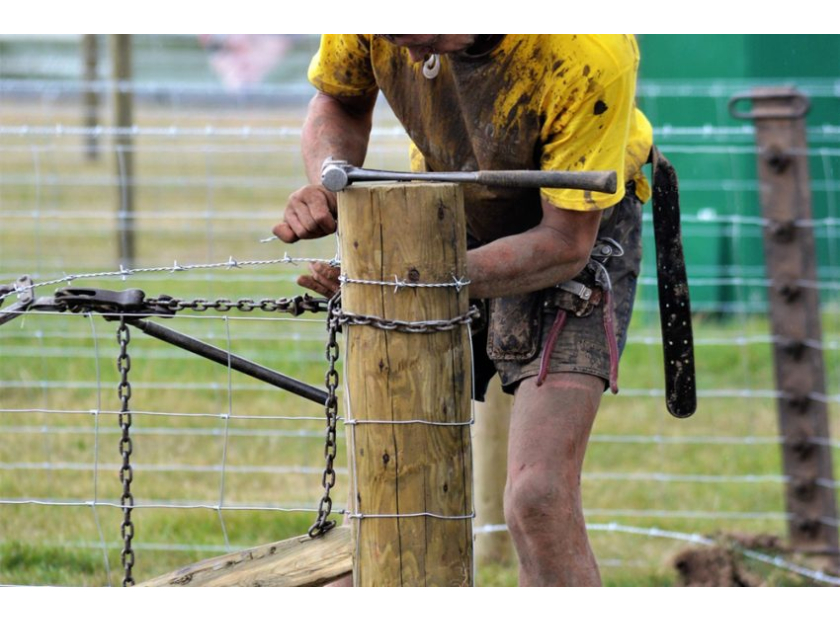

For any farmer, selecting the right agricultural fencing is crucial. It's not just about how it looks; it's about creating a safe, secure, and efficient environment for your livestock and land. This guide will equip you with the knowledge to choose the perfect fencing solution for YOUR farm, along with top tips and recommendations on all things fencing.

-

Posted: December 22, 2023Categories: BlogsRead More

Painting your home is a chance to refresh your space and express your style, but it shouldn't come at the cost of your health, or the planet. That's where Dulux interior paints come in, offering a vibrant palette of possibilities while minimising environmental impact. So, let's find out why low VOC paints are the sustainable option, how Dulux leads the way in sustainability, and how to create an attractive, eco-friendly home with the perfect Dulux paint for each room.

-

Posted: December 19, 2023Categories: BlogsRead More

As winter approaches, construction sites become increasingly challenging environments to work in. The shorter days, harsher weather conditions, and slippery surfaces pose unique risks to workers' safety. To ensure the well-being of your team and maintain productivity throughout the winter months, it's crucial to implement effective safety measures.

-

Posted: October 25, 2023Categories: BlogsRead More

Maintaining a warm and energy-efficient home is crucial, especially during the colder months. Implementing effective insulation strategies not only keeps your space warm but also helps reduce utility costs to help save you money. Here are FIVE valuable and budget-friendly tips to help you insulate your space effectively.

-

Read More

As the calendar flips to autumn and temperatures start to drop, it's time to prepare your home for the upcoming winter. Your roof, in particular, requires attention to ensure it's ready to withstand the challenges of the cold season.

In this blog, we'll explore practical autumn roofing tips, useful roof repair products and home care advice that anyone can follow to keep their roof in top condition as winter approaches. Let's dive into the key areas of concern and maintenance.

-

Posted: August 24, 2023Categories: BlogsRead More

A well-maintained driveway not only adds to the appeal of your home but also provides a smooth and safe entrance for your vehicles. Whether your driveway is made of tarmac, gravel or block paving, proper care and maintenance are essential to ensure its longevity and aesthetic appeal. In this driveway guide, we'll explore the key aspects of repairing and maintaining various driveway types and provide some valuable tips for upkeep.

-

Posted: July 10, 2023Categories: BlogsRead More

In this ultimate beginner’s guide to pressure washers, we will delve into everything you need to know about these powerful cleaning tools. Whether you're looking to clean your patio, decking, or even your car, a pressure washer can make the task quick and easy. In this comprehensive guide, we’ll cover everything from how pressure washers work, to the different motor types you can choose from.

-

Read More

In this blog, we explore another way of laying porcelain paving, Pedestal Support Systems. This method can allow for better water drainage and accessibility, to find out more...keep reading!